DStv And Showmax Subscribers Bid Farewell To Euphoria And Peacemaker As Canal+'s Doesn't Renew Content Deal For HBO And Warner Bros.

Catch Me A Killer, Showmax Original Series, Launches On Canal+'s Polar+ In France Starting January 5th

More Bad News Might Be Awaiting DStv Consumers As MultiChoice And Warner Bros. Discovery Square Off

How Netflix's Potential Acquisition Of Warner Bros. Discovery Affects M-Net, DStv And Showmax?

MultiChoice Is In Trouble As M-Net And Showmax Are Also At Risk Of Losing Content From HBO, TLC And Cartoon Network

Afrikaans Adaptation Of The Office To Premiere In January On Showmax

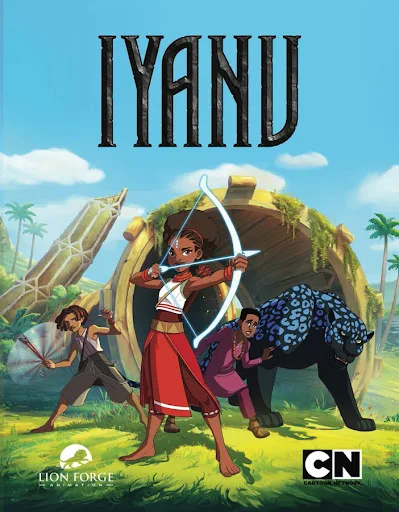

Cartoon Network Will Not Be Airing Iyanu Following It's African Release On Showmax

Why Canal+ Wants To Acquire Comcast's Stake In Showmax?

Spinners,’ The South African Sports Drama From Canal+ And Showmax, Returns For Season 2

VIU And HBO Max Bundle Is Launching In Southeast Asia, Showmax Likely To Follow Soon For Consumers In Africa

Recap: MultiChoice Showed Signs Vulnerability At First Hearing When Talking About Showmax

Canal+ To Launch Streaming Service MyCanal In Eastern Europe By The End Of 2026 Followed By Asia, Could It Replace DStv Stream And Showmax In Africa?

Iyanu Premieres On Showmax With All-Nigerian Voice Cast

Cartoon Network & Max Greenlight ‘Iyanu’ S2 Plus Two Movies

SABC Looking To Produce And License Content To Netflix And MultiChoice

MultiChoice Will Be Removing Qwest TV From The DStv Platform From 14 May, No Word On Showmax

GOODBYE!!! MultiChoice And M-Net Dump 1Max From The DStv Platform By The End Of March, Unveils New Content For DStv Consumers

Viewers of DStv channel Mzansi Magic (channel 161) will have access to 1Max content from 31 March 2025, MultiChoice announced on Wednesday (12 March).

1Max, which was launched in April 2024, features content from popular streaming platform Showmax. It is available to DStv Premium and Compact Plus subscribers in South Africa.

However, MultiChoice has now decided to close it on the DStv platform and migrate its content to Mzansi Magic, according to a MyBroadband report.

‘1Max’ content coming to ‘Mzansi Magic’

“The decision follows detailed research into audience consumption behaviour,” MultiChoice said, adding that it’s part of the company’s channel simplification process.

Many Mzansi Magic viewers are DStv Compact subscribers, which means they previously could not watch Showmax content if they were not Showmax subscribers. They can now watch titles such as:

• Ithonga: A new telenovela about the bond shared by twins, starring Bonko Khoza.

• Cobrizi: The spin-off of the Emmy-nominated and multi-award-winning hit The River.

• Inimba: A new telenovela about Zoleka Mabandla. It is a journey of love, sacrifice, and ambition.

• Genesis: A high-stakes telenovela set in the world of Mzansi’s gospel music scene.

Season 2 of the award-winning Shaka Ilembe which premieres in June 2025.

Although 1Max is closing on DStv, its content is still available on demand on Showmax, which is free for DStv Premium subscribers and comes at a discount for lower packages, including Compact.

This means that viewers can watch their favourite Showmax content on demand on the streaming platform or as part of scheduled programming on Mzansi Magic on DStv.

“We know that our customers want to find their content as quickly as possible, without having to navigate across multiple channels or platforms,” MultiChoice South Africa CEO Byron du Plessis said.

“This consolidation also allows Mzansi Magic to further build its stellar lineup, becoming a stronger premium local content offering than ever before.”