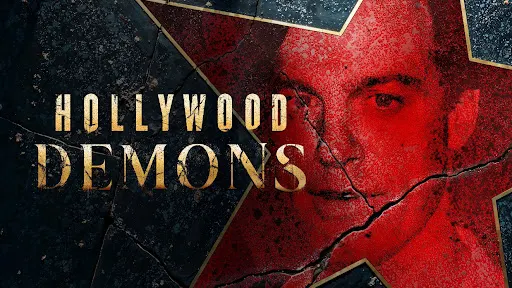

For 11 years, Stephen Collins graced the screen as the altruistic Rev. Eric Camden on 7th Heaven. However, his squeaky-clean image is shattered when a recording of him admitting to inappropriate sexual conduct with underage girls is leaked. In this intense and emotional two-hour premiere of HOLLYWOOD DEMONS, one of Collins’s alleged victims comes forward in a shocking tell-all interview, revealing the disturbing truth about the actor she once idolised. Crew and castmates from the iconic series, including Jeremy London, also share their reactions to the bombshell accusations, leaving them reeling in the aftermath. The premiere episode of HOLLYWOOD DEMONS, “Stephen Collins, America’s Dad,” premieres on Friday, 16 May at 21:00 CAT.

A complete rundown of episodes this season includes:

Child Stars Gone Violent

Premieres Friday, 23 May at 21:00 CAT

In the golden era of ’90s family-friendly TV, child actors weren’t just stars—they were America’s sweethearts. But for some, the transition out of the spotlight dragged them down a path of crime, addiction, and violence. Former child actors Brian Bonsall (Family Ties) and Dee Jay Daniels (The Hughleys) unpack the harsh reality of life after fame, while producers from Home Improvement and That’s So Raven reveal their brush with young stars who ended up behind bars.

Dark Side of the Power Rangers

Premieres Friday, 30 May at 21:00 CAT

Every ‘90s kid remembers Mighty Morphin Power Rangers, the ultimate live-action superhero show. Beneath the bright spandex and high-flying karate kicks lies a grim reality of tragedy and scandals. Viewers will watch never-before-seen footage of a fan-turned-gunman who had one horrifying mission: to assassinate the show’s most legendary star. And just a few years later, the same actor meets a grim fate.

Housewives Gone Bad

Premieres Friday, 6 June at 21:00 CAT

The Real Housewives began as a dazzling display of wealth and luxury, but over the past two decades, tragedy and criminal activity have shaken their glamorous worlds. For the first time, a former colleague breaks down how one housewife built her multimillion-dollar empire on deception. And The Real Housewives of Beverly Hills’s Taylor Armstrong speaks out like never before, shedding new light on her husband’s alleged abuse and the unsettling rumors that still surround his death.